In the fast-paced world of food and beverage (F&B), margins are thin, expansion is aggressive, and operational complexity is high. While menu innovation and location strategy get most of the attention, one critical factor quietly shapes profitability across large F&B chains: lease management. Today, brands that invest in lease clarity through smart digital tools are uncovering significant ROI—often saving millions annually.

The Hidden Cost of Lease Blind Spots

For multi-location F&B operators, leases are not just legal documents; they are financial instruments. Rent escalations, revenue share clauses, CAM charges, lock-in periods, and exit penalties all directly impact store-level profitability. Yet, many chains still manage leases through scattered PDFs, emails, and spreadsheets.

The result? Missed renewal windows, incorrect rent payouts, untracked escalation clauses, and disputes over common area maintenance charges. Individually, these issues may seem minor. Collectively, they erode margins and slow decision-making—especially during rapid expansion or portfolio rationalisation.

What Does Lease Clarity Really Mean?

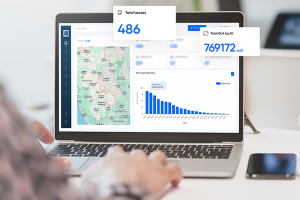

Lease clarity goes beyond simply digitising documents. It means having complete, real-time visibility into every lease obligation across the portfolio. Smart lease management tools centralise agreements, structure critical data, and convert static contracts into actionable insights.

With clarity, F&B leaders can instantly answer questions like:

- Which stores are approaching rent escalations or renewals?

- Where are revenue-share clauses impacting margins?

- Which leases are misaligned with current store performance?

This visibility enables proactive decision-making instead of reactive firefighting.

Direct Financial ROI: Where the Savings Come From

Lease clarity delivers immediate, measurable financial gains by eliminating rent overpayments, missed escalations, and unplanned penalties embedded in complex lease terms. With accurate, real-time visibility into obligations, F&B chains can protect margins while making better-informed decisions on renewals, exits, and expansions. Here’s how lease clarity drives direct financial impact.

1. Rent & Escalation Accuracy

Automated tracking ensures rent payments align exactly with lease terms. Several F&B chains have discovered overpayments running into crores due to missed escalation caps or misapplied clauses. Correcting these errors delivers immediate savings.

2. Stronger Lease Negotiations

Data-backed insights empower brands during renewals. Understanding historical rent trends, occupancy costs, and store performance enables more effective negotiation of better terms, shorter lock-ins, or more flexible exit clauses.

3. Portfolio Optimization

Lease clarity allows chains to identify underperforming locations early. Armed with clear exit timelines and penalty visibility, brands can shut or relocate stores with minimal financial leakage.

4. Reduced Legal & Compliance Costs

Centralised documentation reduces dependency on external legal reviews for basic queries and minimises disputes with landlords. Compliance risks drop when obligations are clearly tracked and met.

Operational ROI: Speed, Scale, and Control

Beyond direct cost savings, smart lease tools drive operational efficiency. Expansion teams can onboard new locations faster, finance teams gain confidence in forecasts, and leadership gets a single source of truth across cities and formats.

During audits, fundraising, or M&A activity, structured lease data significantly reduces due diligence timelines—often becoming a decisive advantage.

The Bottom Line

For F&B chains, the ROI of lease clarity is tangible and measurable. From plugging revenue leaks to enabling smarter expansion decisions, digital lease tools are transforming leases from static paperwork into powerful business assets.

In a sector where every percentage point counts, the brands saving millions are selling better food and managing smarter leases.

Platforms like CRE Lease Matrix reflect a shift in mindset: leases are no longer static paperwork, but structured assets that deserve the same rigour as revenue and cost data. By bringing clarity, accountability, and visibility to leases, such platforms help brands manage one of their highest fixed costs with confidence.