In today’s data-driven business environment, managing leases isn’t just about keeping track of dates and payments — it’s about extracting meaningful insights that drive smarter decisions. That’s where lease management software comes in. Turning raw lease data into actionable intelligence empowers businesses to improve performance, reduce costs, and enhance portfolio strategy.

Let’s explore how lease management software provides deep visibility into lease performance.

1. Centralized Data, Smarter Insights

Manual lease tracking often results in siloed data, spread across spreadsheets, emails, and paper files. Lease analytics software consolidates this information into a single platform, creating a unified source of truth. With this foundation, the software can generate real-time insights across all lease agreements, locations, and asset types.

For example, businesses can view performance by region, lease type, or property class. This makes it easier to identify underperforming assets or pinpoint opportunities for renegotiation and consolidation.

2. Cash Flow and Cost Analysis

Lease obligations are a major part of corporate expenditures. Lease management software provides detailed breakdowns of recurring and one-time costs, including base rent, CAM (common area maintenance), taxes, and utilities. With this level of detail, financial teams can forecast cash flows more accurately and assess the long-term viability of each lease.

Advanced tools also allow for scenario planning, such as projecting the cost impact of early lease terminations or exercising renewal options.

3. Performance Benchmarking

Lease management software doesn’t just show your lease numbers — it helps you understand them in context. By benchmarking performance metrics (like cost per square foot, revenue per lease, or occupancy rates) across locations, you gain a comparative view of your portfolio’s health.

This allows you to identify outliers, replicate successful strategies, and flag leases that need strategic attention.

4. Compliance and Risk Mitigation

Lease compliance is no longer optional, especially with standards like Ind AS 16 in place. Lease management software automatically flags upcoming critical dates, missing documents, or deviations from lease terms. They also help ensure you’re prepared for audits with clear reporting trails and organized documentation.

Risk indicators, such as unusual rent escalations or clauses that could trigger penalties, can be tracked and visualized easily, allowing proactive management.

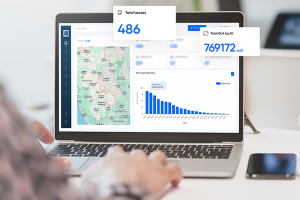

5. Custom Reporting and Dashboards

Modern lease management software provides the flexibility to create customized dashboards tailored to the unique needs of different users—whether finance teams tracking expenses, legal teams overseeing compliance, or operations managers monitoring lease performance and occupancy.

Reports can be generated on demand, scheduled for regular delivery, or filtered for granular insights. This improves communication across departments and ensures everyone is working from the same playbook.

6. Data-Driven Decisions for Growth

Ultimately, lease management isn’t just about monitoring what has happened — it’s about informing what should happen next. Whether it’s choosing to renew a lease, exit a location, or negotiate better terms, analytics give decision-makers the evidence they need to act confidently.

With CRE Lease Matrix, businesses can stop guessing and start strategizing. It transforms static lease data into dynamic insights. From financial performance to risk assessment and strategic planning, it equips businesses with the clarity and confidence needed to optimize their lease portfolios. If you’re still relying on spreadsheets and manual reviews, it may be time to turn your leases into a true performance asset.