The banking sector is undergoing a strategic transformation. While physical branches continue to serve as vital touchpoints for trust and customer engagement, banks are also rethinking how they manage and optimize their real estate portfolios to improve efficiency and agility. In this evolving landscape, intelligent lease management software has emerged as a critical enabler. It has brought accuracy, visibility, and control to complex, multi-location portfolios.

In a highly regulated and financially sensitive environment, data is foundational to risk management. Lease data, though often overlooked, can quickly become a hidden liability when managed poorly. Missing clauses, outdated rent schedules, or untracked renewals can lead to financial leakages, audit observations, and compliance gaps. For banks, where precision is non-negotiable, effective lease management is a strategic and risk management imperative.

1. Operational Inefficiencies and Financial Leakage

Banks typically operate out of a large and diverse real estate portfolio, including branches, ATMs, and corporate offices spread across multiple cities. Each property comes with its own lease agreement, renewal cycle, escalation clauses, and termination terms. When lease data is incomplete or inaccurate, banks face the risk of missing critical dates such as rent renewals, lock-in expirations, or termination notice periods. These lapses can lead to overpayments, lease auto-renewals on unfavorable terms, and even unexpected evictions—all resulting in direct financial losses.

2. Compliance Risks

Banks are held to rigorous compliance standards, not just by financial regulators but also by internal governance policies. Real estate lease obligations play a key role in financial reporting, cost audits, and operational disclosures. Missing lease clauses, especially those tied to termination conditions, security deposits, or escalation timelines, can lead to misstatements in financial reporting or breaches in regulatory compliance. Moreover, without a complete lease trail, internal auditors and compliance teams face roadblocks in ensuring accountability.

3. Impaired Decision-Making

When data is scattered across emails, Excel sheets, paper files, or disparate folders, strategic decisions, such as optimizing branch networks, negotiating lease terms, or budgeting for future expansions, are based on guesswork rather than data. Missing or outdated lease information prevents banks from performing comparative analysis, forecasting rental costs, or understanding portfolio performance, weakening their negotiating position with landlords or developers.

4. Digital Transformation Gaps

Banks are heavily investing in digitization to streamline customer experiences and backend operations. Ironically, lease management—a function closely tied to operational costs—often remains manual and outdated. This disconnect becomes a bottleneck in banks’ broader digital transformation journeys.

The CRE Lease Matrix Advantage

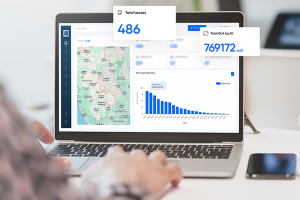

CRE Lease Matrix is purpose-built to solve these problems. It digitizes and centralizes all lease documents—commercial approvals, LOIs, term sheets, agreements, and addenda—making them easily accessible and audit-ready. Using AI-powered data abstraction and a maker-checker process, the platform ensures lease data is accurately extracted and segmented. Automated alerts for critical dates, customizable reports, and interactive dashboards provide real-time visibility and control over your lease portfolio.

Banks and financial institutions can monitor compliance, forecast rental obligations, benchmark against market trends, and act decisively—all from a single, secure platform. As proven in real-world use cases, CRE Lease Matrix can help banks save crores in rentals, eliminate inefficiencies, and strengthen negotiation strategies.

In an industry where precision is paramount, incomplete lease data is a risk no bank can afford. CRE Lease Matrix helps you eliminate that risk—quietly, efficiently, and profitably.