In commercial real estate, accuracy in tracking lease details is crucial—not just for compliance but also for optimizing space utilization and profitability. One of the most essential metrics for landlords, occupiers, and asset managers to monitor is GLA, or Gross Leasable Area. Especially in scenarios involving partial occupancy or shared spaces, understanding and leveraging GLA can have a direct impact on revenue recognition, rent calculations, and strategic decisions.

What is Gross Leasable Area (GLA)?

Gross Leasable Area refers to the total floor area that a tenant can lease and use exclusively. This includes basements, mezzanines, and any internal spaces specific to the tenant but excludes common areas such as lobbies, elevators, and staircases. Unlike gross floor area, GLA is a more tenant-focused measurement—critical for calculating rent, CAM (common area maintenance) charges, and evaluating property performance.

Why GLA is Central in Lease Management?

When a space is fully leased, calculating returns, charges, or KPIs is relatively straightforward. However, partial occupancies introduce complexities. For example, if a 50,000 sq. ft. shopping center has 30,000 sq. ft. leased, revenue forecasting, service charge allocation, and ROI analysis must all reflect this nuance. Without accurate GLA tracking, occupiers may overpay, and landlords may underreport potential revenues.

GLA also plays a key role in portfolio performance metrics like occupancy rate, rental yield per square foot, and escalations. These metrics drive decisions about whether to renew a lease, reconfigure a space, or initiate capital improvements.

Partial Occupancy and Shared Spaces

Partial occupancy isn’t just about vacant units—it often includes temporary closures, underutilized areas, or co-leased spaces such as pop-up stores or shared office hubs. Lease dashboards that integrate real-time GLA data allow property managers to adapt CAM charges, monitor utility usage, and adjust operational costs in response to fluctuating occupancy.

For tenants, knowing the exact GLA leased across multiple locations can help compare leasing efficiency, benchmark store sizes, and optimize future space requirements.

The Importance of GLA in Digital Dashboards

Modern lease dashboards, powered by real-time analytics, provide visibility into GLA across properties and time periods. This empowers stakeholders to:

- Compare lease terms across locations based on per-square-foot cost.

- Track escalations accurately, especially when tied to a leased area.

- Automate alerts for underutilized or overutilized spaces.

- Visualize partial occupancy trends for strategic planning.

Dashboards that omit GLA risk provide skewed insights, leading to misinformed decisions and lost revenue opportunities.

How CRE Lease Matrix Helps?

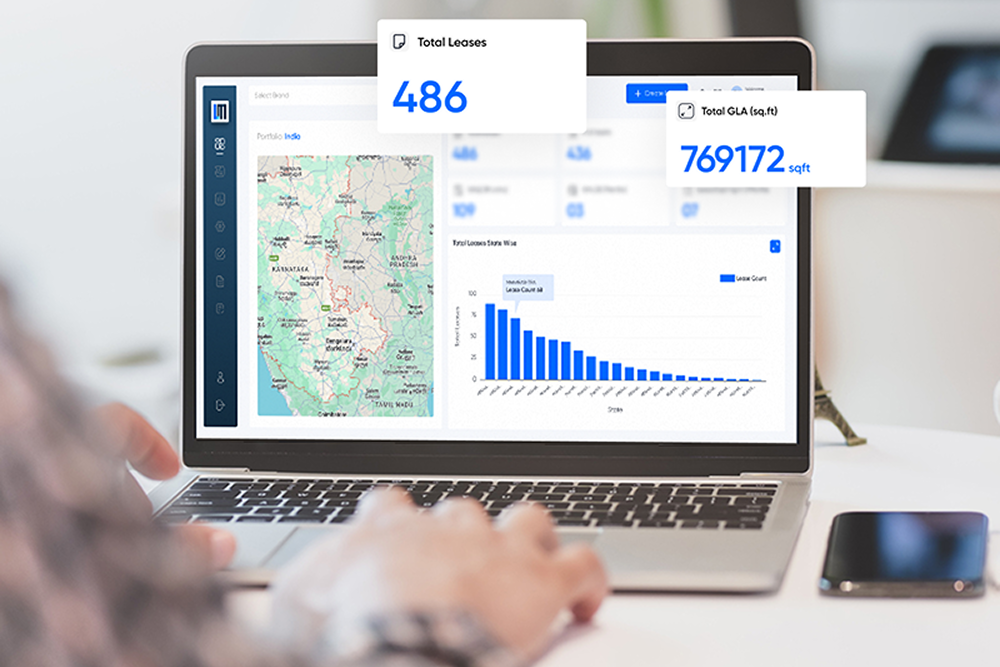

CRE Lease Matrix, India’s most evolved lease administration platform, places GLA at the core of its lease analytics engine. With dynamic, interactive dashboards, users can view GLA data across assets, time frames, and lease statuses—all in one place. Whether you’re tracking rent escalations, managing multiple properties, or evaluating leasing performance, CRE Lease Matrix ensures your decisions are backed by accurate and actionable GLA data.

The platform simplifies lease lifecycle management with features like automated critical date alerts, centralized document storage, and advanced reporting—all tailored to the unique needs of developers, landlords, and occupiers. With scalability, 24/7 access, and a robust maker-checker workflow for data accuracy, CRE Lease Matrix transforms lease oversight into a strategic advantage.

Want to optimize your lease portfolio with precise GLA insights? Explore how CRE Lease Matrix can make a measurable impact.