As businesses prepare their financial roadmaps for FY 2026, one area demanding strategic attention is lease cost forecasting. For multi-site occupiers and landlords alike, lease costs are a significant line item—often accounting for a large portion of operating expenses. With escalating rents, dynamic market conditions, and evolving lease structures, predicting next year’s lease obligations accurately can yield major financial and operational advantages.

The key to a reliable lease budget lies in understanding the past. By analyzing historical lease data, businesses can uncover patterns and predict future costs more confidently. Here’s how:

1. Review Historical Lease Performance

Start by collecting and consolidating all relevant lease documents and financials from the past 3–5 years. Look into rent escalation clauses, step-ups, CAM charges, taxes, and renewal terms. Determine what was actually paid versus what was forecasted to identify variances and reasons—unexpected maintenance, missed clauses, or misjudged escalations.

2. Track Escalation Trends

Understanding how rent and operational expenses have escalated over time—either by fixed percentages or market-linked adjustments—will give you a realistic projection of increases for FY 2026. For instance, if leases typically escalate by 5% annually, budgeting accordingly can protect against surprises.

3. Factor in Critical Dates

Lease expiries, renewal options, rent-free periods, and termination windows all impact annual costs. Therefore, missing a renewal deadline or failing to trigger an early exit clause can lead to inflated holding costs. A thorough timeline of these dates helps avoid such pitfalls and budget more accurately.

4. Incorporate Market Intelligence

Your past lease rates compared against current market trends can highlight over- or under-valued leases. If you’re overpaying relative to the market, renegotiation or relocation might be strategic options—actions that must be considered in your FY 2026 plan.

5. Plan for Contingencies and Expansion

Past data also offers insight into flexibility needs. Were there surprise expansions, closures, or relocations? Factoring in contingency reserves or budget flexibility for portfolio shifts can make your plan more resilient.

6. Use Tech to Centralize and Automate

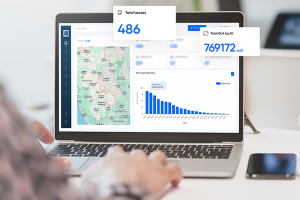

Manual lease tracking via spreadsheets is not only inefficient but error-prone. Adopting digital platforms that centralize lease data, automate reminders, and generate reports can drastically reduce budgeting errors and time spent on administrative tasks.

Why CRE Lease Matrix is the Right Partner for FY 2026 Planning

CRE Lease Matrix, a specialized lease management software, empowers businesses to make smarter lease budgeting decisions through centralized lease management, real-time analytics, and automated alerts. It simplifies historical data extraction, tracks critical dates, and enables rent escalation analysis, allowing users to forecast lease expenses with confidence. Whether you’re a developer, retailer, or office occupier, the platform’s customizable reports and intuitive dashboards ensure that every financial assumption is based on accurate, timely data.

As you set your budgets for FY 2026, let CRE Lease Matrix transform how you manage lease costs, from reactive tracking to proactive planning.