The banking sector is in the midst of a strategic transformation. While physical branches remain critical touchpoints for customer trust and service, banks are also focusing on optimizing their real estate portfolios to reduce costs, improve agility, and enhance operational efficiency. In this evolving landscape, smart lease management software has emerged as a key enabler, helping banks manage everything from rapid branch expansion to complex multi-location portfolios with precision and ease.

Navigating Complex Branch Networks

Banks often operate hundreds or even thousands of leased properties, from flagship city branches to ATMs, regional offices, and call centers. Each of these comes with unique lease terms, renewal timelines, escalation clauses, and compliance requirements.

Traditional spreadsheet-based methods fall short when managing such scale and complexity. Lease data gets scattered across departments, renewal dates are missed, and critical clauses are overlooked. Smart lease management software centralizes all lease information in a single, secure platform, giving real estate and finance teams complete visibility and control over their branch network.

Streamlining Branch Expansion and Rationalization

As banks open new branches in high-growth areas or rationalize underperforming ones, lease agility becomes crucial. Manual processes often delay decision-making and increase transaction risks.

Lease management platforms provide real-time insights into existing lease commitments, upcoming expiries, and market benchmarks. This empowers banks to:

- Identify opportunities to strategically relocate or consolidate branches.

- Negotiate better lease terms for new locations.

- Plan expansion with a clear understanding of long-term cost implications.

For example, if multiple leases in a region are set to expire within a six-month window, the system can flag these in advance, allowing teams to assess performance metrics and decide whether to renew, relocate, or exit.

Automating Financial Tracking and Compliance

Lease costs for banks go far beyond base rent. Common area maintenance (CAM) charges, property taxes, marketing funds, utilities, and service charges all contribute to the total occupancy cost. Tracking these manually across a vast portfolio is error-prone and time-consuming.

Smart lease management software automates cost tracking by standardizing expense categories, applying lease-specific logic, and accurately allocating costs. Integration with accounting systems ensures that financial data is always up-to-date, reducing reconciliation efforts and minimizing disputes with landlords.

Moreover, compliance with accounting standards is simplified through built-in calculation engines that handle right-of-use assets, liabilities, and lease modifications seamlessly.

Enhancing Decision-Making with Analytics

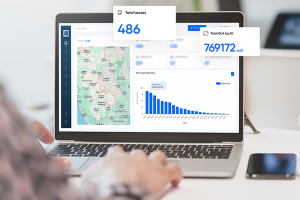

Banks are increasingly adopting data-driven portfolio strategies. Lease management platforms offer dashboards and analytics that highlight cost trends, space utilization, renewal patterns, and performance at both branch and portfolio levels.

With these insights, banks can make informed decisions, such as:

- Optimizing footprint in low-performing areas.

- Negotiating portfolio-wide rent reductions.

- Aligning branch strategy with shifting customer behavior.

The result is a leaner, more responsive real estate portfolio aligned with business goals.

Building Agility for the Future

In a rapidly changing financial landscape, flexibility is key. Smart lease management solutions give banks the ability to adapt quickly — whether it’s responding to regulatory shifts, adopting hybrid work models, or adjusting their physical presence to match digital banking trends.

For banks, leasing is now about strategically managing a complex portfolio to drive operational efficiency and cost optimization. Smart lease management software acts as the backbone of this transformation, enabling banks to expand intelligently, manage costs transparently, and make data-backed real estate decisions.

Empowering Banks with CRE Lease Matrix

CRE Lease Matrix is designed to meet the specific leasing challenges faced by banks and financial institutions. From managing thousands of branch leases to tracking real-time occupancy costs and ensuring compliance with global accounting standards, the platform provides an end-to-end digital solution. Its intuitive dashboards, automated alerts, and advanced analytics empower banking teams to make proactive, data-driven decisions. With CRE Lease Matrix, banks can achieve true portfolio transparency, streamline lease operations, and align their real estate strategy with long-term business objectives.

Ready to make smarter leasing decisions?

Discover how CRE Lease Matrix can help your bank optimize every square foot of its portfolio, from branch expansions to lease renewals.